Welcome to MASEconomics, your trusted source for economic insights. In the ever-shifting landscape of the global economy, keeping a close watch on central banks’ decisions and statements is paramount. The Federal Reserve’s recent statements (September 2023) and actions have shed light on its monetary policy stance. In this article, we will analyze these announcements to understand their implications for the U.S. economy better.

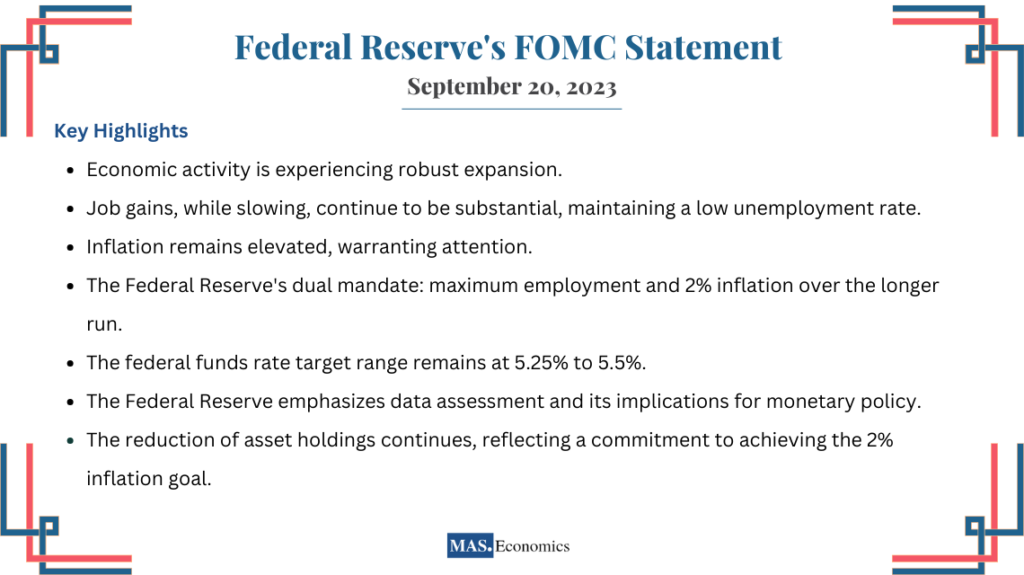

Federal Reserve’s FOMC Statement – September 20, 2023

Interpreting the FOMC Statement

The Federal Reserve’s statement portrays an economy amid healthy growth, albeit with some nuances. While slowing in recent months, job gains are still robust enough to keep the unemployment rate at a historically low level. However, the specter of elevated inflation looms large.

To address these economic conditions, the Federal Reserve maintains a steadfast commitment to its dual mandate: achieving maximum employment and sustaining inflation at a 2% rate over the long term.

In line with these objectives, the Federal Reserve has chosen to leave the target range for the federal funds rate unchanged at 5.25% to 5.5%. This rate serves as a linchpin, affecting the interest rates banks charge one another for short-term loans and subsequently influencing a plethora of financial instruments and consumer debt.

Crucially, the Federal Reserve recognizes that the impact of monetary policy is cumulative and is, therefore, vigilant in monitoring economic and financial developments. This implies that the ongoing effects of past actions will influence future policy decisions.

Additionally, the Federal Reserve remains committed to reducing its holdings of assets, which has already seen a substantial reduction of $815 billion since June 2022. This approach reflects its dedication to achieving the 2% inflation objective.

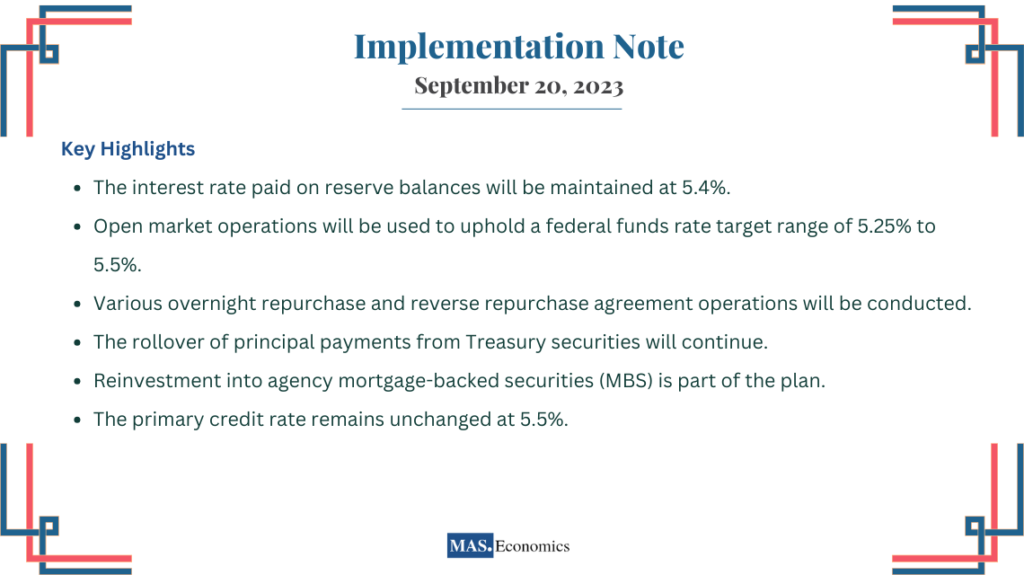

Implementation Note – September 20, 2023

Interpreting the Implementation Note

The Implementation Note outlines the practical steps the Federal Reserve intends to take to execute the monetary policy in the FOMC statement.

Firstly, the interest rate paid on reserve balances will be 5.4%. This rate has implications for banks’ decisions regarding holding excess reserves at the Federal Reserve.

The Federal Reserve also instructs the Open Market Desk to engage in various operations to ensure the federal funds rate remains within the target range. These operations encompass repurchase agreements, reverse repurchase agreements, and the rollover of Treasury securities.

Moreover, the Federal Reserve plans to reinvest in agency mortgage-backed securities (MBS) and holds the primary credit rate steady at 5.5%.

Our Perspective

Looking beyond the surface of these statements, it becomes evident that the Federal Reserve is navigating a delicate economic landscape with caution and precision. By maintaining steady interest rates, the central bank signals its intention to carefully manage inflation while fostering economic stability.

The Federal Reserve’s commitment to its dual mandate of maximum employment and 2% inflation remains unwavering. Its decision to keep the federal funds rate within a specific range demonstrates its dedication to these goals.

Additionally, the continued reduction of asset holdings underscores the Federal Reserve’s determination to achieve its inflation target. This reduction in the central bank’s balance sheet reflects a proactive approach to shaping the nation’s economic trajectory.

As we move forward, observing how these decisions impact economic outcomes and financial markets will be crucial. The Federal Reserve’s role as a steward of economic stability and inflation control remains pivotal, making its statements and actions of utmost importance to investors, businesses, and individuals alike.

Conclusion

The Federal Reserve’s recent statements and actions reflect a measured approach to safeguarding economic health. The path it carves will significantly influence the trajectory of the U.S. economy, cementing its position as a linchpin in global financial affairs.

Stay informed, stay ahead, and keep learning with MASEconomics!

Disclaimer: This article provides an analysis of the Federal Reserve’s FOMC statement and Implementation Note. It provides context and insights for readers but does not constitute financial or investment advice.